GM’s robotaxi dream has been prematurely clamped

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

What’s the difference between General Motors and Tesla? Kind answers only, please.

As of this week there’s a new distinction between the two US carmakers: only one wants to be a robotaxi company. General Motors has shelved its goal of building and managing a fleet of autonomous rideshare vehicles through subsidiary Cruise. It is a gesture of discipline by boss Mary Barra, but that doesn’t mean it makes long-term sense.

GM had invested more than $10bn in Cruise since acquiring it in 2016. There had been setbacks — like the accident that left a pedestrian gravely injured, which GM initially attempted to minimise. Ultimately, Barra decided that the future cost of robo-chauffeuring, from huge capital outlays to regulatory compliance and general management stress, was too high.

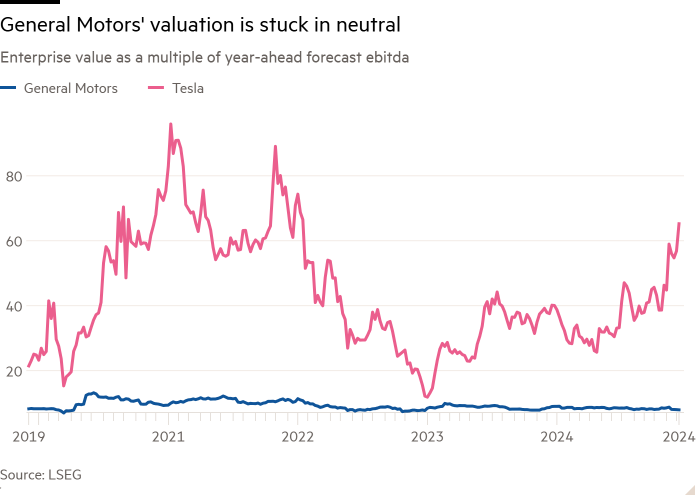

Meanwhile at Tesla, Elon Musk’s plans for a robotaxi fleet have received a much warmer welcome — even though they’re no less nebulous than GM’s. Tesla’s forecast earnings for next year of $10.3bn are a little lower than its rival’s, based on Bank of America estimates, yet its market capitalisation is more than 20 times bigger at $1.3tn. Tech fund and Musk booster Ark Invest thinks Tesla’s self-driving cabs could justify over $7tn of market value.

Sure, Tesla has advantages GM lacks. Raising new capital is easier, both because Tesla is so much bigger, and because the soaring value of Musk’s various companies makes him catnip to growth-hungry investors and prospective employees. GM’s other main robo-rival Waymo, meanwhile, enjoys the very deep pockets of parent Alphabet, which throws off about $75bn of free cash flow a year. Barra can’t compete on that front.

The main difference between GM and Tesla, though, is that their investors seem to want different things. In Barra’s case, they seek parsimony and share buybacks. Given the car sector’s history of booms, busts, strikes and recalls, this is not totally surprising. The $1bn a year that GM will save from its robotaxi U-turn may seem more valuable today than a share of an uncertain future market, even if it is potentially large.

In the tech sector, investors are much more accustomed to faith-based spending, and not just at Tesla and Alphabet. Facebook owner Meta has so far sunk more than $50bn into its Reality Labs division, which is developing virtual reality headsets. Amazon is investing $10bn in Project Kuiper, a fleet of more than 3,000 broadband satellites; only two have been launched so far.

Still, all this feels a little unfair to GM. After all, if robotaxis are indeed a huge opportunity, Barra’s company should have as good a chance as anyone. True, it can now focus on selling self-driving cars without worrying about who’ll finance, maintain and clean a fleet of company-owned cabs. But it is a shame that investors’ focus on a turbulent past is keeping GM from fully embracing the future.

#GMs #robotaxi #dream #prematurely #clamped