Traders pay record premium for European gas next summer

Stay informed with free updates

Simply sign up to the Energy crisis myFT Digest — delivered directly to your inbox.

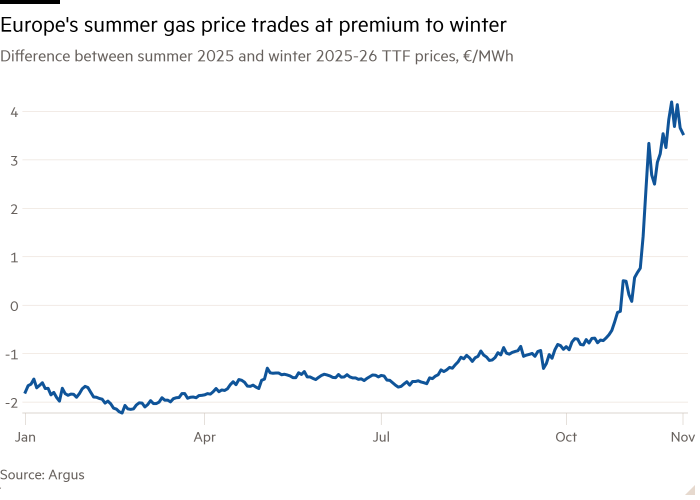

European gas traders expect prices next summer to be higher than the following winter, an unusual bet that reflects the steep cost of refilling the continent’s storage facilities as it tries to wean itself off Russian supplies.

Natural gas in Europe has historically tended to be cheaper in the summer when demand is lower. That has incentivised traders to buy in the hotter months and store gas to sell at a profit during the winter peak heating season.

However, gas for delivery next summer is now being priced at a record premium to the winter that follows. That gap reflects an expectation that Europe will draw heavily on its gas storage during the current winter, and will then have a hard time restocking in the summer months.

The abnormal price relationship “is itself exacerbating worries about how Europe will manage to fill storage in summer 2025,” said Natasha Fielding, head of European gas pricing at Argus Media, a pricing agency.

Expensive summer gas “removes the commercial incentive” to rebuild stockpiles, she added.

In late November, the price of the European benchmark Title Transfer Facility in the summer of 2025, assessed by Argus, traded at a premium of more than €4 per megawatt hour to the winter 2025-26 price, the biggest premium ever to the winter price at this time of year.

Russia shut down the majority of its pipeline gas supplies to the EU in the run-up to and aftermath of the invasion of Ukraine in 2022.

In response, Brussels brought in a rule requiring member states to fill their gas storage to 80 per cent of capacity by the start of each November. Traders say the EU target, which has since been raised to 90 per cent, was pushing summer prices higher.

The mandate was not an issue in the past two years as Europe exited winter with record gas storage levels, lessening the scale of the summer top-up operation.

But analysts are expecting Europe to exit this winter with lower levels of gas than the previous two, and potentially much lower if much colder weather sets in.

The EU’s gas was 86 per cent full as of Wednesday, 10 percentage points below the same time last year. The rate of drawdown of reserves from the start of winter — typically October in the gas market — is at its fastest since 2016, according to data from Gas Infrastructure Europe, an industry body.

Traders are also bracing for a halt to Russian supplies coming through Ukraine, one of the two remaining pipeline routes to western Europe, when a transit agreement expires at the end of the year. The other route, via Turkey, may also be affected by US sanctions on Gazprombank, the lender that handles the bulk of Russia’s overseas energy revenue.

If the summer price premium persists, EU regulators are likely to mandate the purchase of more gas, said analysts at consultancy Energy Aspects.

At the height of the energy crisis in 2022, some European governments ordered domestic companies to buy gas from the global market at record high prices in order to meet the storage mandate.

The high summer gas price is a reflection of traders “speculating that the government will intervene again and fill storages at whatever cost, even if it is unprofitable”, said a gas trader.

#Traders #pay #record #premium #European #gas #summer